activity: technology and the sales process

Marketing continues to evolve and the 4 marketing quests provides an insight as to how this evolution will continue.

Marketing through technology has evolved in small incremental steps – with each step below our perceptual threshold and it is really only when we take the time to stop and think about the evolution do we realise just how much has changed in recent years. Like many areas of marketing, the buyer decision process and the sales process have been evolving with technology.

Theory suggests that there are five conditions for adoption –

- Relative advantage: the customer must see an advantage in adopting the product

- Compatibility: the new product must be compatible with the customer’s lifestyle – there must be minimal disruption to the consumer’s life

- Complexity: the new product must be relatively easy to understand and incorporate into the consumer’s life

- Trialability: there is an opportunity to use/test the product prior to purchase

- Observability: other customers can be seen with the product and enjoying the benefits of the product (Rogers,1962; 1995)

This activity explores conversations with sales managers and salespeople in the Western Australian retail new car market. I think that it is fair to say that how we buy cars, and how we use cars will evolve and one day in the future we will reminisce about the ‘good old days’.

After completing the activity your task is to consider how technology has influenced other purchases.

In this activity we will explore how technology has modified the buyer decision process for a motor car. We will explore it from both a customer’s and an organisations perspective.

For most consumers, the motor car is a high involvement purchase [with involvement not necessarily related to the price but a consumer’s ability and willingness to purchase], a specialty product, and a durable product rather than a consumable. It is directed towards multiple levels of needs and the concept of self. Awareness, recognition and recall of motor car brands is high, new models generally have a two-year product life cycle. Brand positioning is generally well known, however, features, benefits, and pricing of the product range would be low [as consumers may not track market changes when not in the market]. The marketing channel is extensive; branding reveals primary [type], secondary [brand] and tertiary [dealer] categories. Historically, primary demand is managed by industry associations, secondary branding conveyed through the traditional printed brochure, however, the printed brochure is generally superseded by sophisticated interactive web site with downloads and then links to the dealer. Although the goods are produced at arm’s length and shipped intact, other product components [services, ideas, experiences, people, and place] are generally delivered face to face. Within the dealerships motor car salespeople are employed to assist the consumer to search, estimate value, and select an appropriate product. In addition, salespeople will assist the consumer with a range of consequential products such as customisation through options, finance, and insurance

Whilst undertaking the research for the activity: price, pricing, and the product life cycle I had an interesting conversation with a 62 year old, motor car salesperson, we were in the sales yard, it was a winter’s day and the weather was brisk, he wore a branded wind jacket. I discovered that he had over 20 years experience selling a mass-market brand. I was expecting him to say that things were tough and reminisce about the ‘good old days’, however, he was very optimistic – and this surprised me – and later in a process of introspection I felt that I had approached the conversation with a little bias – which as a qualitative researcher is not good practice. He stated that the sales process has retained the fundamentals, however, because of the internet it was much easier today. He stated that most customers conduct extensive online product searches and have refined their considered set of options and have eliminated a number of products prior to entering the salesyard [see decision-making rules in the e-book].

When asked what are the fundamentals; the salesperson stated that selling cars requires a love of people and a strong desire to help. He added that if you are authentic, work hard, and adapt to the different consumers you can make a good living – and deserve to. However, he added if you are playing on your phone, indicating a younger salesperson in the warmth of the showroom, and don’t want to learn the craft, have an inability to be mentored you will be moved on quickly. Some people, ‘want the rewards but don’t want to do the hard yards’. What many people who enter this ‘game’ don’t get is that car yards are on prime land with expensive buildings and there is a big investment in stock; so while we have to think of the customer we have to think about the dealership [he was saying that in addition to providing a service to the consumer he was also providing a service to his employer]. Therefore, to get results I have to allocate my time carefully, but, if I get a qualified buyer who has demonstrated a good knowledge of a particular can and we go for a test drive a then I am on my way to making a sale – sales are the goal.

I reflected on what the salesperson in the branded wind jacket had said and considered whether this would apply for other brands, for example, buyers of niche brands, semi-luxury brands and luxury brands. Out of curiosity, I visited a number of brands across the spectrum – I timed my visits for early in the day where access to the sales managers and salespeople was more likely.

At the sales yard of a niche brand [$25K-$50K] an experienced salesperson who moved to retail motor car sales 6 months previously stated that the internet provides him with the opportunity to study the qualities of competing brands – each night he ‘swotted’ for a few hours. Knowing that consumers visited online car sales websites; he kept updating his knowledge about prices and which brands held their value better; he also visited online car sales website and kept his eyes on the daily newspapers with a particular focus ‘on the automotive sections’. He saw his move into car sales as a bit of a calculated risk and an opportunity to combine his love of cars and sales, and when an opportunity arose with a really good high-volume brand he jumped at the chance. When quizzed on what were the risks he stated that some brands were now selling new cars direct via online showrooms – he stated that this could accelerate and reduce the demand for traditional showrooms. He said that some newer brands may skip the traditional approach and have a web-site showroom and then run pop-up showrooms in the major shopping centres. Interestingly, there are branded showrooms already in some shopping centres in some cities. He also stated that some of the chit-chat from ‘old hands’ was that we live in a sharing economy and this could have huge implications regarding ownership of motor vehicles.

In a sales yard of a luxury brand, a sales person, this time in a well-fitting suit, succinctly stated that ‘buyers once did their homework in the showroom – now they do their homework online … they have a greater understanding of the market and sometimes a better knowledge of our competitor’s current offerings’. He then apologized that he must be excused as a client needed his attention – managing time and being customer centric is a key success factor. What is also apparent is that a luxury brand requires that all product components are in keeping with the luxury positioning.

Luxury [and semi-luxury] motor car salespeople stated that as price increases the considered set of alternatives narrows. Discussions with car salespeople across all price points suggests that selection follows the traditional patterns of the self-concept [see ‘the self’ in the e-book]. When I asked for an example one salesperson stated ‘people with a Ferrari often go for a Sunday drive – you have to have a Ferrari to join in – it is the same for all luxury cars’. What is also interesting was the salespeople’s observation that wealth did not eliminate online searching – ‘if anything they are more brand loyal, but often loyal to more than one brand, they may have a week car and a weekend car and they know everything about their brands. There is rivalry and competition between brands, similar to what you find with football teams. When asked how has the salesperson’s role has changed over the years; a salesperson at the higher end of the luxury ladder indicated that today the salesperson doesn’t sell in the traditional sense instead it is about providing a preview of the experience that the car will deliver and also ‘facilitating the sale’. Some of the ‘old hands’ stated that although visitors to the motor car showrooms were fewer they were more qualified and this has changed the sales process 100%.

Other salespeople stated that most cars are now reliable and good value for their price; they partly attribute this to the power consumers have with social media channels. Furthermore, motor car manufacturers regularly conduct online customer satisfaction surveys and whilst this can display aggregate satisfaction data it can also be drilled down to reveal customer satisfaction at a dealership level and reveal the collective satisfaction for dealers, salespeople, and service departments – as one salesperson stated highlighted ‘we are scrutinized – micromanaged – and there is nowhere to hide’ and a sales manager said ‘at the back of your mind you are thinking if I don’t manage this aggressive customer carefully they may contact the manufacturer and it doesn’t matter if they are in the wrong – the customer is always right and the salesperson is always wrong’.

One self confessed ‘conflicted’ salesperson stated that manufacturers want salespeople that provide service, however, the dealers still needs salespeople that can convert a suspect into a prospect and then into a customer. When you consider that salespeople rely on their sales commissions you can see that salespeople are the meat in the sandwich and they are rewarded by the employer for sales and not providing service. However, whilst customers demand good service they are also unwilling to pay for the service. Customers want information but they are unwilling to pay for the salesperson’s knowledge.

A finance manager of one group stated that technology was a blessing and a burden. When asked to elaborate he stated that his company spent too much money targeting ‘suspects’ that had moved on to another brand or had since purchased a vehicle. In the old days the salesperson would have more control of the process – get a lead, work the lead, get an appointment. Today the salespeople are working 60 hours a week minimum. However, in his opinion the rigor and the discipline of sales is being interrupted by technology. When asked what he meant by rigor he stated that the old school knew the status of every lead that walked in the door. He put forward the view that today, he is seen as a dinosaur, but once you put an advert in the paper and the phone would ring and if it rang 100 times you got 20 serious enquiries and if you worked them well you got 5 sales. Go to the motoring section of the newspapers and that way of business has disappeared.

A retired motor car dealer agreed that consumers, manufacturers, dealerships and salespeople will face some major challenges – but professional salespeople will always be in demand and the ‘golden rules of business will always apply – buyers do not care how much you know they want to know how much you care.

Tasks

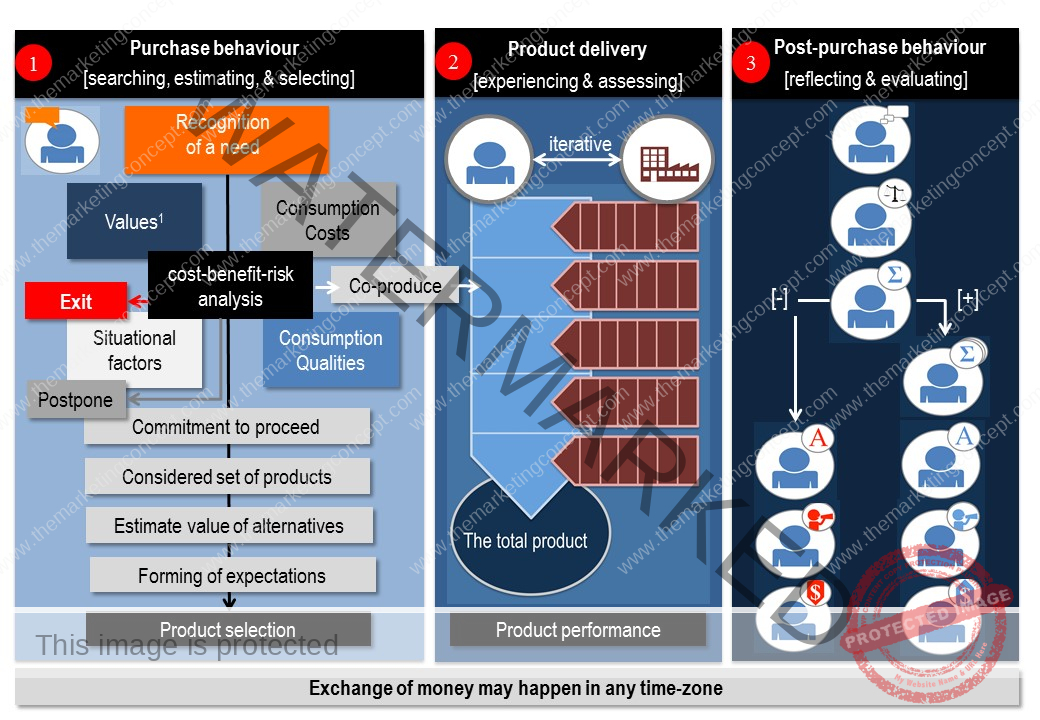

- How has technology changed the 1st time zone of the buyer decision process?

- Discuss how a customer’s ability and willingness to purchase will influence the 1st time zone of the buyer decision process?

- What is customer involvement with a product and how does it vary from product to product?

- Consider your consumer behaviour in the 1st time zone of the buyer decision process and discuss how technology has influenced you purchasing.